You are here

Creating Offsetting Payments to Clear A/R Balance

Theatre Manager uses a process called "Invoice Matching" in its accounting. This means each invoice (order) needs to balance to itself.

If you refunded tickets on one order (creating a credit balance to the patron), but purchased tickets in another order (creating a debit balance from the patron), then the orders are unbalanced. The patron account may appear good, but the orders within the patron record are unbalanced. This is why it is important to keep edits to an order within the order itself, and not create a separate order.

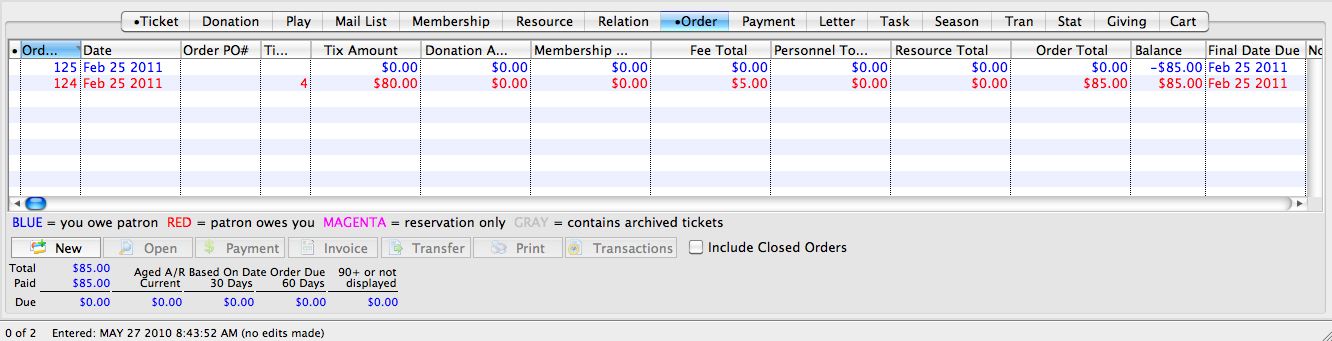

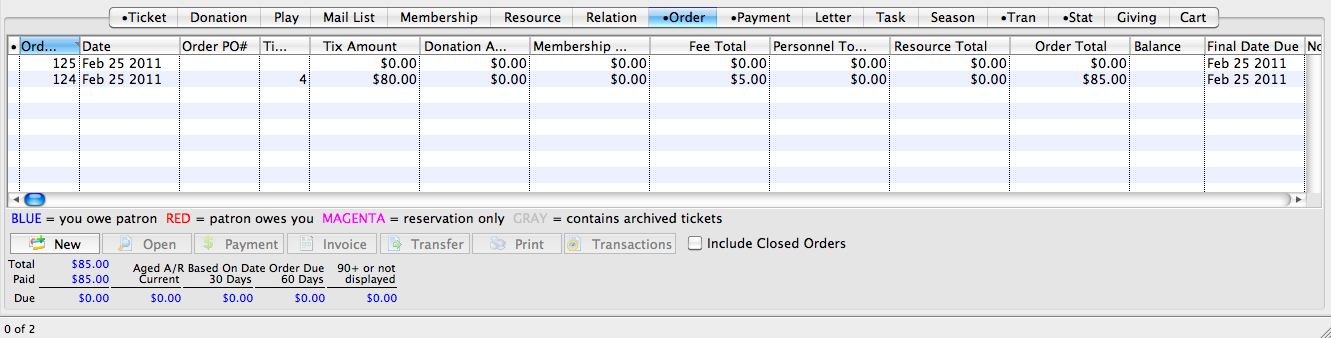

In this example, the patron has two orders. One with a balance due to the patron of $85, and one with a balance owing from the patron for $85. Note the Balance column on the right side of the image below.

To repair this, you need to make a CASH refund to the credit balance order, and a CASH payment to the debit balance order.

To take care of the credit balance, you perform the following steps:

- Return to the patron record, and click the

tab.

tab.

Select the credit balance order (the one in blue).

- Click the

button.

button. - In the Payment window, create a REFUND (negative payment) for the full value of the order.

Choose CASH as the payment method.

- Click

button.

button.

- Return to the patron record, and click on the

tab

tab

Highlight the debit balance order (the one in red).

- Click the

button.

button.

Make a payment for the full value of the order and use CASH as the payment method.

- Click

button.

button.

|

At your End Of Day, the GL Journal Entry Summary by Account will show a net effect to CASH of $0. The GL Journal Entry DETAIL by Account will show $85 CASH in, and $85 CASH out. |